The most important thing to do to get better at handling your personal finance is tracking them (in my opinion). By tracking your expenses you’ll be able to analyze where your money is going, and take action from there.

Today I have gathered three ways that you can use to track your expenses as a student.

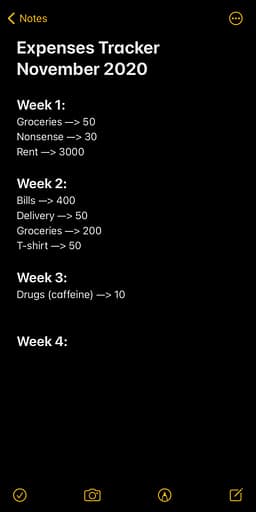

1 – The Notes app

Yes, the first app I used to track my expenses was the default Notes app on my iPhone.

Although it might lack many features that might help you calculate different things, it’s still very simple which makes it much easier to work with.

If you’re new to tracking expenses, I would suggest that you start using the Notes app or just a regular Notebook.

By using something this simple you won’t worry too much about the technical aspects of the app (I’m a software engineering student and I still used the default Notes app).

How to track expenses using the Notes app?

There are different ways to track your expenses, but I prefer the simplest one: just write down whatever you buy and categorize them by different timelines.

You can split the expenses by weeks or months (I prefer weeks). And by the end of each month, you can look back at your purchases and categorize them even further and apply some calculations.

The downside to the Notes app is that you’ll need to calculate everything yourself each month. Which takes us to the second app:

2 – Google Sheets

I moved from using Excel to Google Sheets (for reasons that I won’t discuss in this post) for my personal finances.

What’s different about Google Sheets is the customizability.

Although the Notes app is good enough to write down your expenses, it’s not great for calculations.

This is where Google Sheets comes in.

You can make charts, calculate the sum, make projections, create an income sheet, and integrate it with the expenses…etc.

Your imagination (and time) is the limit.

I personally just make a few calculations, but I’m planning on adding more features to my Google Sheet.

Although I created my expense tracking sheet myself, there are multiple expense tracking sheets available online that you can start using straight away and modify them to your needs later.

The only downside to Google Sheets in my opinion is that you need to know how to work with sheets (or at least learn the basics) in order to get the best value out of it.

3 – Spendee

If you’re not a fan of creating your own system for tracking expenses, then maybe using an app like Spendee is the right solution for you.

I’m gonna be honest here, I haven’t really used Spendee for a long period of time, I just checked the app and tried some of its features and it looks…. very promising!

The app is very intuitive and easy to use from my experience. You just add your balance and start recording your transactions. You then get access to different analytics.

Another interesting feature is that you can directly connect your bank account with the app in order to make the process even more seamless.

The downside to this app is as usual: customizability.

With Google Sheets, you can calculate everything you want to (assuming you know how to use it). But with Spendee you’re limited to what your plan offers (there’s a free and a paid plan).

I do however think that this is a great app for those who don’t want to get very technical (which is most people).

Conclusion:

Whether you’re using the Notes app or Google Sheets or Spendee or any other app, the most important thing is that you’re keeping track of your expenses.

This will allow you to make important decisions that will affect your life either in a positive way or in a negative way in the future.

We will talk more about personal finance here on the college route so that we can all get to live a happy balanced life (assuming this is what you want of course haha).